WHO WE ARE

A Managed Discretionary Account With High Growth Potential

A Client-Focussed Solution

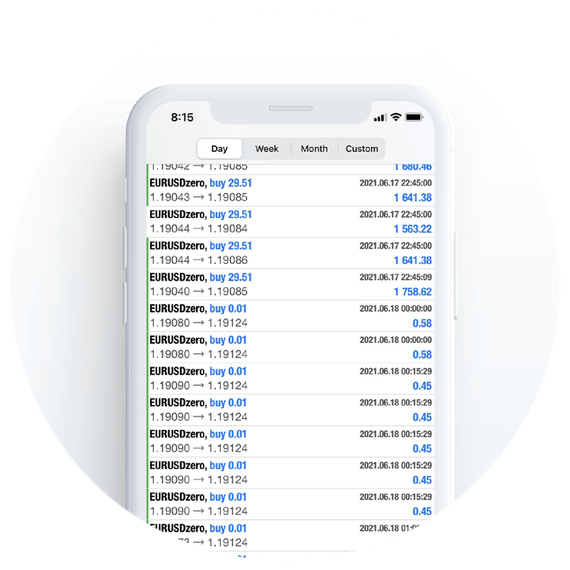

Created with transparency in mind, FXAIS Capital's MDA solution provides wholesale investors with full control over their investments and real-time access to the trading data used to ensure optimal performance. With fewer decisions to make, wholesale investors can focus on what matters most to them while our expert investment managers take care of the rest.

By choosing an MDA solution with FX Capital, wholesale investors can take advantage of our automated investing technology with the peace of mind that comes from expert oversight and guidance. Whether you're a risk-averse investor looking for downside protection or an aggressive investor looking for higher potential returns, our MDA solution has the flexibility to help you achieve your financial goals.

PAST PERFORMANCE

2022 Trading Cup Winner

WHAT WE OFFER

What Is a Managed Discretionary Account?

A managed discretionary account (MDA) is an investment account that allows an authorised third-party broker or investment manager to make investment decisions on your behalf. Managed discretionary accounts may utilise advanced trading algorithms, real-time data analysis, and complex market modelling to identify investment opportunities and outperform traditional investment strategies.

By leveraging a managed discretionary account, wholesale investors can access a wide range of investment opportunities with minimal hassle and maximum trading efficiency. Unlike traditional discretionary accounts, managed discretionary accounts are highly scalable and provide eligible investors with targeted returns that align with your investment goals and risk-profile.

MDAs offer the added benefit of flexibility, allowing wholesale investors to choose the level of risk they are comfortable with and select a customised investment strategy that meets their needs. And unlike traditional investment accounts, managed discretionary accounts are highly scalable and provide wholesale investors with access to the tools and resources they need to achieve their financial goals.

With an MDA, wholesale investors can enjoy the peace of mind that comes with expert investment management and access to emerging markets and opportunities. With lower trading fees, diversified investment portfolios, and easy-to-use account management tools, an MDA is an ideal choice for hands-off wholesale investors seeking to invest in high-performing assets and maximise their returns.

INVESTING WITH US

The FXAIS Capital Difference

Advanced Technology

Only the most sophisticated trading algorithms and real-time data analysis tools are used to drive our investment decisions, providing our clients with exceptional performance and high returns.

High-Liquidity

Our managed discretionary accounts are highly liquid, allowing you to access your capital at any time from your personal Australia-based account.

No Lock-in Contract

Our redemptions minimum investment period is 1 month; Redemptions are available on call after 1 month.

Risk Mitigation

We continually monitor our AI’s performance to minimise unnecessary trade volatility and ensure that our investment strategies continue to deliver consistent, reliable results.

Market Neutrality

Our AI trading technology is designed to be market neutral, meaning that performance is driven by fundamental signals rather than market conditions alone.

Reporting Transparency

Daily reports are provided to clients, detailing all trade activity and performance insights for increased transparency.

ACCOUNT MANAGEMENT

Performance Fees

FXAIS Capital has a simplified and straightforward performance fee structure, with no hidden commissions or deductions on profits. A single performance fee of 25% of the increase in the account's net asset value (NAV) is applied monthly and is based on a high watermark. No performance fees will be assessed in the case of a decline in NAV. Performance fees will resume whenever the watermark is broken, and will only be assessed for the subsequent increase in NAV.

Third Party Transaction Fees:

Some third-party transaction fees related to specific account transactions may vary over time. Full disclosure of commissions and third-party fees is provided in the investment agreement provided during account setup.

| SERVICE FEE TYPE / DESCRIPTION | FEE AMOUNT |

|---|---|

| Establishment Fee (for account opening) | Nil |

| Withdrawal Fee | Nil |

| Exit Fee (for account closure) | Nil |

| Third Party Transaction Fee (incl. broker transactions) | Refer to the terms of service provided by our broker partner |

| Management Fee | Nil |

| Performance Fee | 25% of each month’s return (profit) |

TRADING WITH US

Joining FXAIS

Our services are tailored to the needs of our clients across multiple industries:

HIGH NET-WORTH INDIVIDUALS

COMPANIES

CORPORATE TRUSTS & SMSF

FINANCIAL ADVISORS

Who Can Invest In Our MDA?

To qualify to invest with FXIAS, prospective clients must meet one of the following criteria:

• Be a wholesale investor with a minimum amount of $500,000 to invest; or

• Be a professional investor according to section 9 of the Corporations Act; or

• Be a person, company, or trust, with net assets of at least $2.5M or a gross income for the last 2 financial years of at least $250,000.a

Account Setup Process

1

Setup

Set up and fund your trading account with our Australian based broker Pepperstone.

2

Select Risk

Decide on the level of risk you are comfortable with and sign the associated documents.

3

Connect

We connect your account to our system allowing us to place trades on your behalf.

4

Review

We review your account’s growth at the end of each month and deduct our performance fee.

OUR BROKER PARTNER

World Class Broker Service

Broker services are provided by our partner Pepperstone Group. They are responsible for providing dealing services to clients, which includes execution, clearing and holding client funds.

Pepperstone was founded in 2010 in Melbourne, and are globally regarded for their superior technology, low-cost spreads and a genuine commitment to clients.

They’ve won multiple prestigious awards from Investment Trends, Deloitte and Compare Forex Brokers and are recognised for consistently exceptional customer service, excellent trading conditions and value for money.

Trusted Around The World

Pepperstone processes an average of US$9.2bn of trades every day*, making them one of the world’s largest forex brokers.

Pepperstone is trusted by over 300,000^ traders around the world.

In addition to being regulated by ASIC, SCB, FCA, DFSA, CMA, BaFin and CySEC, we segregate our client funds with tier 1 banks and offer many fee-free funding methods.

* Based on all average Pepperstone trades from March 2018 until March 2020.

^ Registered Pepperstone accountholders.